U.S. remained world’s largest producer of petroleum and natural gas hydrocarbons in 2014.

PITTSBURGH, PA, June 12, 2015 – The law firm of Babst Calland today released its fifth annual energy industry report called, “The 2015 Babst Calland Report – Appalachian Basin Oil and Gas Industry: Rising to the Challenge; Legal and Regulatory Perspective for Producers and Midstream Operators.” This annual review of energy and natural resources development activity acknowledges the continuing evolution of this industry in the face of economic, regulatory, legal and local government challenges.

PITTSBURGH, PA, June 12, 2015 – The law firm of Babst Calland today released its fifth annual energy industry report called, “The 2015 Babst Calland Report – Appalachian Basin Oil and Gas Industry: Rising to the Challenge; Legal and Regulatory Perspective for Producers and Midstream Operators.” This annual review of energy and natural resources development activity acknowledges the continuing evolution of this industry in the face of economic, regulatory, legal and local government challenges.

In this report, Babst Calland attorneys provide insights into Marcellus and Utica shale issues, challenges and recent developments most relevant to Pennsylvania, Ohio and West Virginia. In general, a significant challenge ahead for shale developers in the current price environment is for operators to continue to be productive and active in finding land and drilling wells while effectively delivering the natural resource to market.

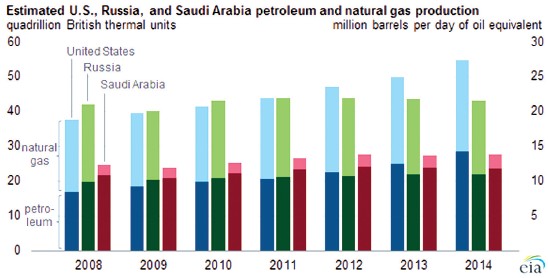

According to the U.S. Energy Information Administration, regional and national natural gas production reached an all-time high at the end of 2014. Thus far in 2015, the oil and gas industry’s rig count in the Appalachian Basin and elsewhere is down substantially compared to the previous two years. Although Marcellus shale development is leading the way in the U.S. natural gas production by producing 17 million cubic feet per day of gas, persistently low gas prices are forcing producers to curtail capital expenditures, adjust staffing and wring cost savings from their respective supply chains.

Joseph K. Reinhart, shareholder and co- chair of Babst Calland’s Energy and Natural Resources Group, said, “This Report identifies the many challenges faced by the oil and gas industry, including commodity pricing, efforts to impose or increase taxes, pipeline capacity, vocal opposition, environmental and litigation challenges, impacts of local regulation, and the growing importance of due diligence in asset transactions.”

The 44-page Report contains five sections, each addressing key challenges for Appalachian Basin oil and gas producers and midstream operators.

- Regulatory shifts and impacts, such as the current proposed amendments to Chapter 78 rules in Pennsylvania, will impose significant new regulatory burdens and create tremendous shifts in how companies manage their conventional and unconventional assets. Also, the focus on potential impacts of hydraulic fracturing and deep well disposal on seismic events may create sweeping changes to what operators will need to install and monitor these facilities. These and other impacts will increase administrative burdens and may create increased legal burdens and business considerations.

- Environmental challenges, resulting from the proposed Chapter 78 amendments, including waste rules, NORM requirements, retention ponds, storage tanks, noise, public resources, stream and wetland buffers, orphaned and abandoned wells, and clean-up standards, among others. Most industries do not confront this many critical environmental issues in one decade, yet the oil and gas industry in the Appalachian Basin is facing these challenges all at once.

- Litigation challenges will remain part of the industry’s landscape given the large number of unresolved regulatory and legal issues. Industry will be required to litigate interpretations of statutes and rules by federal and state regulators and environmental groups and continue to face issues related to the validity of leases and royalty payments. Property owner claims of personal injury and property impact from oil and gas development activities will likely continue, fueled by claims of ground water contamination and adverse health effects of shale development.

- Local government regulatory landscape varies significantly in Appalachia with each of the primary states providing its unique system of local regulatory authority in the oil and gas industry. Pennsylvania continues an uncertain evolution in the aftermath of the Pennsylvania Supreme Court’s decision in Robinson Twp. vs. Commonwealth of Pennsylvania (Act 13). In addition to the expected increase in local ordinance activity resulting from the Act 13 ruling, anti-industry activists are challenging the validity of zoning ordinances. By contrast, West Virginia and Ohio are far more restrictive in the authority afforded to local government to regulate the natural gas industry.

- Negotiation of transactions requires comprehensive due diligence in title, environmental, land use, litigation and/or entering or exiting operations in the Appalachian Basin. Title Due Diligence continues to play a major role in transactions. Cotenancy issues are addressed differently in each state. Pennsylvania acquisitions should include the proposed new Chapter 78 and 78a requirements moving forward, as it is likely that it will take both the oil and gas industry and Pennsylvania’s agencies a significant amount of time to fully implement these changes. Possessing clear title and all necessary environmental permits will be of little value if local ordinances, including zoning and traffic restrictions or construction requirements, do not allow certain activities. Identifying and analyzing a seller’s pending suits and threatened claims and a familiarity with recent case law and pending cases that may adversely affect the oil and gas industry is also a significant aspect of due diligence for oil and gas transactions.

As market conditions evolve for the oil and gas industry in the Appalachia Basin, Babst Calland’s Energy and Natural Resources Group continues to stay abreast of the many current legal and regulatory challenges facing producers and midstream operators.